ESG is the acronym for Environmental, Social and Governance and indicates a rating, often known as a sustainability rating, which is expressed in relation to the environmental, social and governance impact of a company or an organization operating on the market.

The concept of "traditional" sustainability of a company represented by economic sustainability and the ability to generate new value for investors extends to the concept of sustainability towards society and the environment and the ability to generate value for the environment and for society.

MMC, through its partners, assists in the process of defining the processes and procedures for the implementation of the sustainability rating.

The ESG rating appears increasingly important today because it represents an index that not only allows investors to have a greater and deeper understanding of a company's sustainability.

A bit of history

After years of preparation and dialogue, on 12 December 2015 in Paris, on the occasion of the Conference on Climate Change (Conference of the Parties - COP21), 195 countries shared the first global climate agreement, aimed at regulating the post-2020 period .

The Paris Agreement is legally binding, subject to ratification by individual states. Following EU ratification (October 4, 2016) the threshold of 55% of the contracting countries was reached (equal to 55% of global greenhouse gas emissions established by the Agreement itself) and the Agreement entered into force on November 4 of the same year. In Italy, the Ratification and Implementation Law (Law 2016/204) has been operational since 11 November 2016. Worldwide, as of April 2019, 185 countries have ratified the Agreement (Economic and Social Council 2019).

Unlike other treaties, the one of Paris provides for the universal participation of countries and the presence of identical obligations for any developing state of the country: developed versus developing.

In September 2015 in New York, on the occasion of the UN summit on sustainable development, world leaders adopted the 2030 Agenda for Sustainable Development. States have thus tried to provide a response to common challenges, sharing a plan that could help put an end to poverty and create the conditions for prosperity in a healthier world based on peace. In essence, the 2030 Agenda constitutes an important piece of an inclusive multilateralism process, which already began with the adoption of relevant global agreements, including the one described above in Paris.

The 2030 Agenda for sustainable development includes 17 objectives (Sustainable Development Goals - SDGs), to be interpreted as a continuation of the eight Millennium Development Goals, defined by the member states of the UN in 2000 with the intention of completing them by 2015. In reality, their realization was only partial; hence the need to set new objectives – the 17 SDGs in fact – which have a decidedly more ambitious connotation compared to the Millenium Goals, as they are aimed at eliminating poverty rather than reducing it and at expanding the scope of intervention of some goals, including those related to health, education and gender.

In December 2015, the Financial Stability Board set up the Task Force on Climate-related Financial Disclosures (TCFD) to develop recommendations on climate risk disclosure in order to promote more informed investment, credit granting and insurance policy offering decisions . The Task Force is composed of 32 members, selected by the Financial Stability Board and drawn from heterogeneous organizations, such as banks, insurance companies, asset managers, pension funds, non-financial companies and rating agencies. The favor encountered by the Task Force can be seen in the growing number of organizations that have declared their support for the recommendations and their commitment to offering transparent and complete information on the risks and opportunities associated with climate change: from 513 organizations in September 2018 jumped to 825 in July 2019.

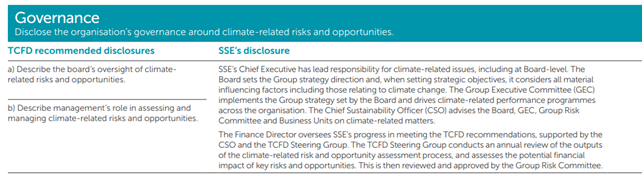

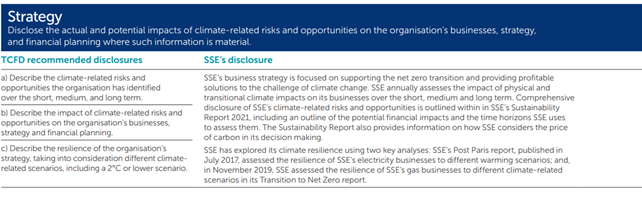

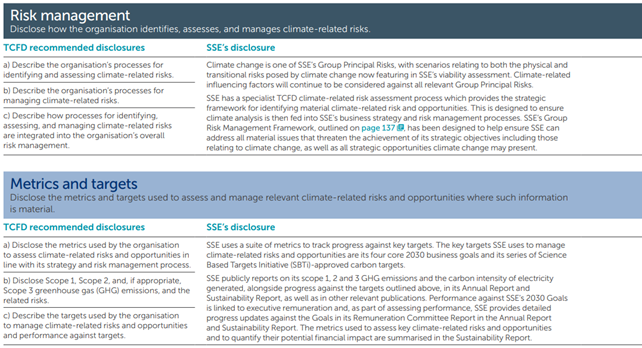

After a broad public consultation on a draft, in June 2017 the TCFD issued a series of recommendations on climate risk disclosure (“Recommendations of the Task Force on Climate-related Financial Disclosures”) with a focus on 4 thematic areas: governance, strategy, risk management, metrics and targets.

The attention of regulators and banking supervisory authorities to the issue of climate change is also demonstrated by the establishment of a forum of voluntary cooperation in which central banks and supervisory authorities from all over the world have joined. This is the Network for Greening the Financial System (NGFS), launched in 2018, in order to promote and raise awareness of the supervisory attention to the issue of financial instability deriving from the risk of climate change. In this perspective, the action of the NGFS aims to outline a trend picture of the existence of any climate risk differentials in the various countries that can affect their financial stability and to define and disseminate best practices for integrating environmental and climate risks into the micro and macro-prudential supervisory activities.

Among the fundamental levers for the support and diffusion of green behaviors, sustainable finance is certainly identified; for this reason, the actions of the NGFS are also aimed at promoting attention towards mechanisms for mobilizing traditional financing to support the transition towards an economy that respects the environment.

a) In summary, the thematic areas on which the NGFS focuses are the following: supervision, aimed at mapping the current supervisory policies on the integration of climate risks into micro-prudential supervisory mechanisms;

b) macro-financial, aimed at the dissemination of information on climate risks by financial institutions in order to estimate the existence of a possible financial risk differential between "green" and "brown" assets;

c) mainstreaming green finance, aimed at outlining appropriate policy rules and market mechanisms to promote capital raising and financing solutions to support the implementation of "green" initiatives on the market.

The management of each issue is entrusted to a commission, chaired by the representative of a central bank participating in the forum.

From the constitution phase to today, the composition of the NGFS has considerably expanded. As of July 2019, the NGFS is made up of 42 Authorities, representing about 2/3 of the banks and systemic insurance companies, whose countries are responsible for 45% of greenhouse gas emissions. The hope of the forum is to further increase the number of members, including a particularly broad and diversified representation by geographical area, both from developed and emerging countries.

In summary, the NGFS Steering Committee has the task of defining the strategy and action plan of the forum; the composition of this body, currently being set up, includes representatives of the participating authorities (to date, Banco de Mexico, Bank al Maghrib, The Bank of England, The Banque de France and Autorité de Contrôle Prudentiel et de Résolution, The Bundesanstalt für Finanzdienstleistungsaufsicht , The Deutsche Bundesbank, The Nederlandsche Bank, Finansinspektionen-The Swedish FSA, The Monetary Authority of Singapore, The People's Bank of China) and one observer (today, The Bank of International Settlement). The NGFS Steering Committee is chaired by a Chair, who has the role of coordinating and organizing the work, supported by a Secretary.

In addition to the activities reserved for its members, the Network intends to further expand its relationships and discussions on topics of interest by also addressing other stakeholders through: the publication of information reports and press releases on the state of the art in terms of combating climate change , the organization of public events and the continuous information activity through a dedicated site, where public consultations can also be launched on specific issues aimed at gathering the opinion of other interested parties (the private sector, the academic world, NGOs, etc.).

Without a doubt, the issues of climate change and the related risks are particularly complex and a depth and breadth of views can allow for a more reliable assessment of the effects on financial stability of climate risks and, more generally, of environmental, social and governance factors (Environmental, Social and Governance - ESG) on the economic systems of the various countries.

THE INITIATIVES AT EUROPEAN LEVEL

On 8 March 2018, the European Commission published the "Action Plan to finance sustainable growth", whose ultimate goal is to contribute to the achievement of the Sustainable Development Goals and the commitments made by the European Union with the signature of the Paris Agreement in 2015. The document builds on the recommendations made by the High Level Expert Group on Sustainable Finance (HLEG) appointed by the Commission in 2016. The purpose of the Action Plan is to incentivize investors and businesses to refocus their financial resources towards low-emission activities and to act in accordance with a sustainable development model. The plan has three main objectives:

1. Redirecting capital flows towards sustainable investments in order to achieve sustainable and inclusive growth;

2. Manage financial risks arising from climate change, resource depletion, environmental degradation and social issues;

3. Promote transparency and long-term vision in economic and financial activities.

These three objectives are broken down into ten actions which envisage initiatives on various fronts with the aim of involving all players in the financial system in reducing information asymmetries linked to climate risks, thus improving the allocation of capital towards sustainable investments.

|

ACTION PLAN TO FINANCE SUSTAINABLE GROWTH |

|

Action 1 Establish a unified EU-wide system of classification of sustainable activities |

|

Action 2 Create standards and brands for sustainable financial products |

|

Action 3 Promote investments in sustainable projects |

|

Action 4 Integrate sustainability into financial advice |

|

Action 5 Develop sustainability benchmarks |

|

Action 6 Better integrate sustainability into ratings and market research |

|

Action 7 Clarify the obligations of institutional investors and managers of activity |

|

Action 8 Integrate sustainability into prudential requirements |

|

Action 9 Strengthen communication on sustainability and the accounting regulation |

|

Action 10 Promote sustainable corporate governance and mitigate short-term view in the capital markets |

Sources:

AIFIRM - Associazione Italiana Financial Industry Risk Managers - April 2020 -Position Paper n. 20

For further details, see the document "Charter of the Central Banks and Supervisors Network for Greening System (NGFS)", available at the following link: https://www.banque-france.fr/sites/default/files/ngfs_charter_20180424_0.pdf

NGFS (2018a), Charter of the Central Banks and Supervisors Network for Greening System (NGFS), April available at the following link: https://www.banque-france.fr/sites/default/files/%20ngfs_charter_20180424_0.pdf

SSE plc Annual Report 2021, available at the following link: https://content.next.westlaw.com/Link/Document/Blob/I7cc534aad27b11ebbea4f0dc9fb69570.pdf?targetType=PLC-multimedia&originationContext=document&transitionType=DocumentImage&uniqueId=50d56c61-6aad-4875-b0d5-33def40ff31a&ppcid=7d45430cd44146a991f0eb5a18965582&contextData=(sc.DocLink)&firstPage=true